Stripe Atlas Review 2025 [UPDATED

Starting a business is exciting—but also overwhelming. Incorporating a company, setting up a bank account, managing equity, and dealing with U.S. tax laws can feel like a maze. Many founders spend weeks buried in paperwork, frustrated by legal jargon, and uncertain about what the next step is.

That’s the problem Stripe Atlas set out to solve. It takes one of the most complicated processes in entrepreneurship—forming and running a U.S. company—and makes it fast, affordable, and founder-friendly.

If you’ve ever dreamed of building a startup, raising capital, or selling globally but got stuck on incorporation and compliance, Stripe Atlas is designed for you. By combining legal formation, banking, and tools in a single package, Stripe has created a service that lowers the barrier to entrepreneurship worldwide.

So, is Stripe Atlas worth it in 2025? Let’s break it down in this in-depth review.

What is Stripe Atlas?

Stripe Atlas is an online platform created by Stripe, the global payments company, to help founders start and manage a U.S.-based business. With just an online application, Atlas helps entrepreneurs:

- Form a U.S. company (usually a Delaware C-Corp, the startup standard)

- Open a U.S. business bank account

- Access legal and tax guidance

- Set up equity and issue shares

It removes the friction of handling paperwork, finding a lawyer, and navigating state and federal requirements. Whether you’re in New York, India, or Nigeria, Stripe Atlas gives you the infrastructure to launch and scale a business that can operate globally.

Who Created Stripe Atlas?

Stripe Atlas was developed by Stripe, the payments company founded by brothers Patrick and John Collison. Stripe is known for powering online payments for millions of businesses, from startups to tech giants.

The Collison brothers noticed that while Stripe simplified payments, entrepreneurs still struggled with the earliest step: incorporation. By launching Stripe Atlas in 2016, Stripe aimed to make starting a U.S. company as simple as launching a website.

Top Benefits of Stripe Atlas

Stripe Atlas offers several advantages that appeal to founders, especially those outside the U.S.:

- Global accessibility – Entrepreneurs from over 140 countries can form a U.S. company.

- Fast setup – Incorporation and bank account setup take days instead of weeks.

- Startup-friendly structure – Incorporates as a Delaware C-Corp, the preferred structure for venture capital.

- Integrated banking – Partnership with Mercury or other U.S. banks simplifies financial setup.

- Equity management – Issue stock to co-founders easily.

- Resources and community – Access to legal templates, tax guidance, and founder networks.

- Credibility – A U.S. entity can improve trust with investors and global partners.

Best Features of Stripe Atlas

Stripe Atlas isn’t just about filing paperwork. Its features are designed around what founders need to get started and grow.

Delaware C-Corp Formation

Stripe Atlas helps you incorporate a Delaware C-Corporation, the gold standard for startups. This structure facilitates the process of raising funding, issuing stock, and working with U.S. investors.

U.S. Bank Account Setup

Stripe Atlas connects you to a U.S. bank partner (historically Silicon Valley Bank, now options like Mercury) so you can quickly open a business account. For international founders, this is one of the hardest steps—Atlas makes it seamless.

Stripe Payments Integration

Once incorporated, you can instantly start accepting payments with Stripe. This is particularly valuable for founders outside the U.S. who want to sell products in North America.

Legal and Tax Resources

Atlas provides access to vetted legal documents (like bylaws and IP agreements) and guides on your U.S. tax obligations. While it may not be a substitute for a lawyer, these resources will save you time, money, and energy.

Founder Community

They let you get access to join a network of global founders. This community offers networking, advice, and collaboration opportunities.

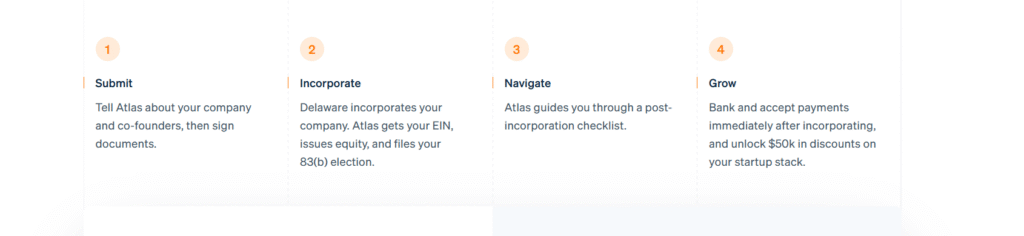

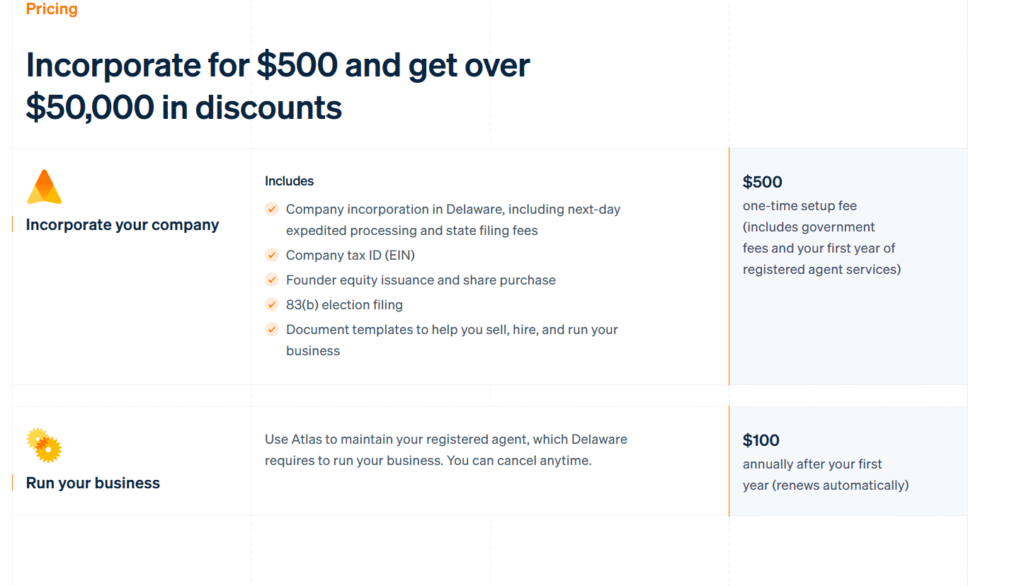

Stripe Atlas Pricing

Stripe Atlas charges a one-time fee of $500. It covers

- Company incorporation

- Employer Identification Number (EIN) from the IRS

- Bank account setup

- Stripe account setup

- Founder stock issuance documents

Stripe Atlas Pros and Cons

No product is perfect. Let’s look at the main strengths and drawbacks.

Stripe Atlas Pros

- Fast and simple incorporation – Paperwork handled in days.

- Global founder access – Available in most countries.

- Investor-friendly structure – Delaware C-Corp standard.

- Integrated banking and payments – Streamlined financial setup.

- Affordable – $500 one-time fee is cheaper than hiring lawyers.

- Community and resources – Access to templates and founder network.

In short: Atlas removes barriers and makes U.S. incorporation accessible. But like any tool, it has trade-offs.

Stripe Atlas Cons

- Not available everywhere – Some restricted countries are excluded from using Stripe Atlas.

- There are annual compliance costs, including Franchise tax, registered agent fees, and filings, that add up.

- Limited customization – Basic legal documents may not fit complex needs.

Stripe Atlas Alternatives

If you think Stripe Atlas isn’t the right fit, here are some alternatives to look at:

- Clerky – Specializes in legal documents for startups raising venture capital.

- Gust Launch – Incorporation plus startup legal and accounting support.

- LegalZoom – Broad online incorporation service, not startup-specific.

- Traditional law firms – More personalized but significantly more expensive.

Stripe Atlas Case Study

Thousands of founders have launched successful companies with Stripe Atlas. For example, an international SaaS startup could:

- Incorporate in Delaware through Atlas.

- Open a U.S. bank account and start charging U.S. customers with Stripe.

- Issue equity to co-founders and later to investors.

- Build credibility to raise venture funding.

The speed and simplicity of Atlas let the founders focus on building their product instead of wrestling with legal and financial setup.

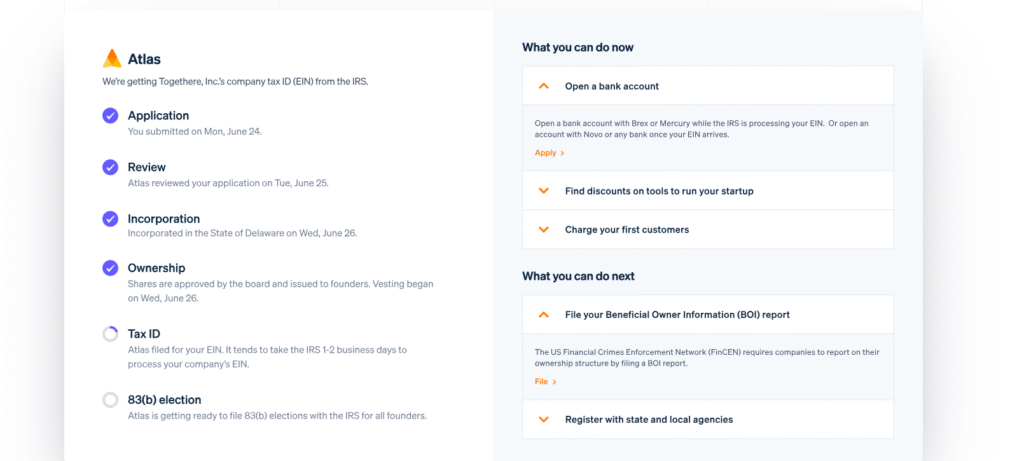

My Experience Using Stripe Atlas

When I tested Stripe Atlas, the process was smoother than expected. The application took less than 30 minutes. Within a week, I had:

- A Delaware company was incorporated.

- An EIN from the IRS.

- A U.S. bank account was opened.

- A Stripe account ready to accept payments.

The most valuable part wasn’t just speed—it was confidence. Instead of wondering if I missed a form or misunderstood a tax requirement, Atlas guided me through every step.

For a founder outside the U.S., this peace of mind is worth the $500 alone.

Conclusion: Should You Buy Stripe Atlas?

If your goal is to build a U.S.-based startup, attract investors, or sell to global customers, Stripe Atlas is one of the most efficient ways to start.

It won’t replace a lawyer or accountant as your company grows, but it gives you a solid, investor-ready foundation at a fraction of the cost. For international founders especially, it removes the biggest friction points: U.S. incorporation and banking.

Bottom line: If you want to launch a company in the U.S. with speed, credibility, and support, Stripe Atlas is an excellent choice in 2025.

Stripe Atlas FAQ

Is Stripe Atlas worth it?

Yes, if you want to incorporate in the U.S. quickly, affordably, and with a structure that’s friendly and easy to manage in 2025.

How can Stripe Atlas help with incorporation?

It handles Delaware LLC/ C-Corp formation, EIN application, bank account setup, and legal templates—all in one package.

Is Stripe Atlas legit?

Absolutely. Stripe is a trusted payments company, and Atlas has helped thousands of founders start companies since 2016.

Do I need to live in the U.S. to use Stripe Atlas?

No. International founders from over 140 countries are eligible to apply.

What are the ongoing costs after using Atlas?

Expect to pay Delaware franchise tax, a registered agent fee, and potential accounting/legal costs each year.